As a South of France property surveyor, one of the questions first-time overseas buyers most commonly ask is – what additional fees can I expect when buying a house in the South of France?

What they’re really asking, of course, is how much will their dream house advertised at €200,000, €300,000, €500,000 or whatever it may be, really cost once they’ve paid the estate agent, the notaire (notary) and any other legal fees and taxes they may not be aware of.

The short answer is it all comes down to what’s included in the asking price – total additional fees can be as low as 2% of the property’s price, or as high as 20% (a nasty shock for some), depending on what the asking price covers.

As such, it’s important to do your homework, ask the right questions – and not set your heart on a property until you’ve conducted all the necessary sums to reveal whether or not the property is within your budget.

Estate Agent Fees

The first thing to be aware of is that not all estate agents in France include the agent’s commission in the advertised price of a property. The second thing is that estate agent fees in France are typically higher than they are in the UK (which currently average at about 1.18% + VAT) – anywhere between 5% and 10% is typical in France.

When looking at advertisements, you need to check whether the purchase price is FAI, or frais d’agence inclus (agent fees included), which means it is the seller who’s responsible for paying the agent’s fees – otherwise it is your responsibility as the buyer to pay them.

Notaire Fees

The frais de notaire (notary fees) cover both fees and taxes and are regulated by the French government. They vary according to the sale price and age of the property.

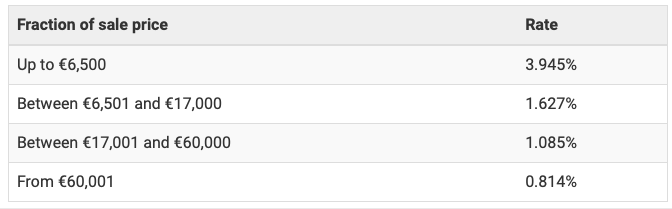

The actual notaire fee itself is usually only about 1%. At time of writing, the precise figure (excluding VAT) is calculated on a sliding scale as follows:

(Image source: french-property.com)

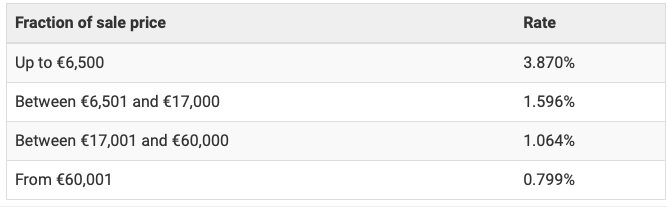

However, these rates are set to be reduced slightly from 1st January 2021:

(Image source: french-property.com)

Please note that these fees exclude TVA (VAT), which you will need to add at 20%.

Also included in the notaire’s fees (which do not, in fact, end up in the notaire’s pocket) is droits de mutation (literally transfer duties – the equivalent of the UK’s stamp duty land registration taxes). These are paid by the buyer at 0.7% for properties less than five years old, or 5.8% (or 5.09% in a select few departments) for older properties.

In summary, the total notaire’s fees and taxes payable for an older property will typically fall between 7% and 10% of the purchase price, whereas for new properties being sold for the first time you will pay around 2% plus VAT at 20%. New properties being sold within five years of being built between private individuals are not subject to VAT, though the usual stamp duty of 5.8%/5.09% is payable.

Surveyor Fees

Sellers in France are required to commission certain diagnostic reports – the Dossier de Diagnostic Technique (DDT). These may be considered as base-level property surveys. They cover tests to determine if there is evidence of termites or the presence of dangerous materials such as asbestos in the property. They by no means, however, equate to a proper survey of the property’s overall condition.

Unlike in the UK, property surveys are not compulsory in France. However, it is highly recommended that you have one conducted – especially considering the high fees associated with purchasing a property in the country. By contrast, property surveyor fees are much more reasonable – and will give you a true, unbiased evaluation of any problems with the property you intend to purchase, the implications of those problems, and what it would cost to fix them.

Depending on the level of survey, you can expect to pay around £250 for a Condition Report, to upwards of £750 for a Full Structural Survey.

Charles Mackintosh South of France Property Surveyor

For more information on the fees for buying a property in the region, get in touch with South of France property surveyor Charles Mackintosh. With over 30 years’ experience living and operating in the region, Charles provides highly regarded English language property surveys and advice for British buyers.