France is undoubtedly one of the most popular destinations to retire to in Europe. Indeed, according to a recent study, there are currently 150,000 Britons living in France, making it the second most popular European country for UK nationals (second only to Spain).

Anyone thinking of retiring to this beautiful part of the world will naturally be looking to buy a house here. Before you start making offers, however, you need to make sure you budget accordingly. This means not only understanding the purchase price for your French property, but the additional and hidden costs that come part and parcel with a property purchase.

From the estate agent’s fees to notary fees and the fees for currency conversion, here are some of the most important additional French property buying costs you need to be aware of.

Estate Agents Fees

The first additional cost to consider is estate agent fees. In France, these will typically equate to between 5% and 10% of the sale price – and it is the buyer that normally pays them.

What’s important to note when looking at property lists is that some estate agents do not include their commission in the listed asking price. If you see the letters “FAI” next to a listing, this stands for “frais d’agence inclus”, which means that the agent’s fees are included in the price. If you don’t see the letters FAI anywhere, be aware that you will likely have to pay an additional percentage on top of the property price.

Notaire Fees

As explained in French-Property.com, the legal fees associated with property purchases in France are known as the “frais de notiare” – which translates to notary fees. However, it must be noted that this is a term that covers both taxes and the notaire fees.

In total, the fees and taxes payable break down as follows:

- Older property – The total conveyancing fees and taxes payable are between 7% and 10% of the purchase price.

- New property – You will pay around 2% in conveyancing fees and registration taxes, plus VAT at the rate of 20% on the purchase price.

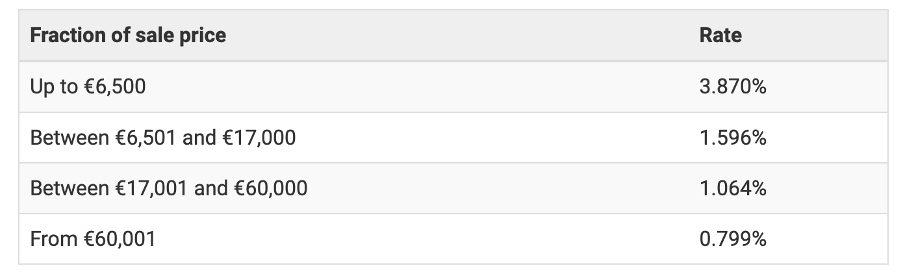

Out of this total, the actual notaire fee itself is only about 1% – the rest is stamp duty registration taxes and disbursements. Notaire fees are regulated by the French government and vary according to the sale price of the property. As of 2022/23, a scale rate of notaire fees (excluding taxes) is as follows:

(Image source: french-property.com)

Currency Conversion

One additional cost many people forget about is the fees associated with converting your money to pay for not only the French property itself, but all the other costs that come with it.

Exchange rates fluctuate regularly. However, if you use a currency exchange company, it’s possible to fix your rate in advance of the exchange so you’ll know exactly how many euros you’re getting for your money.

Legal Representation

While it’s not a necessity to source legal representation when purchasing French property, you may feel it to be a wise move – especially if you don’t speak French. Employing a local bilingual lawyer will ensure that you understand everything before signing on the dotted line.

Charles Mackintosh – South of France Property Surveyor

If you’re in the market for a French property and are looking for more information on the fees and costs that come with the purchase, RICS Chartered Surveyor Charles Mackintosh is at your service. With over 30 years’ experience living and operating in the South of France, Charles provides highly regarded English language property surveys and advice for overseas buyers.

Get in touch today for more information.